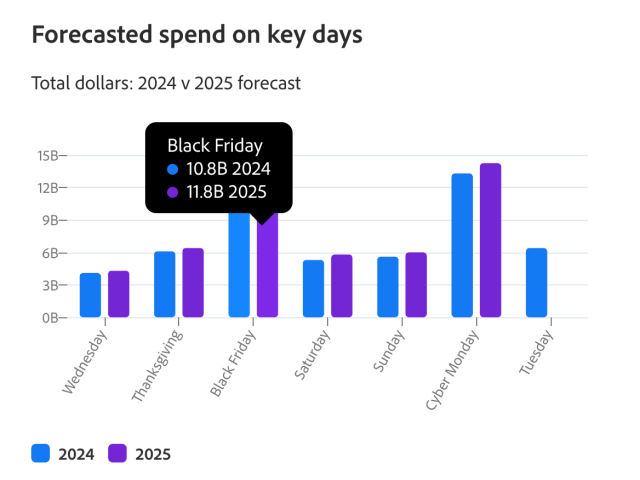

Black Friday 2025 broke every record. Americans spent $11.8 billion online in a single day, more than any other Black Friday in history. But here’s the twist: Even as shoppers filled their carts, consumer confidence slipped to its lowest level since April.

So why are we spending more while feeling worse about our finances? That gap tells us about what’s really happening in American households right now. Let’s break it down in a way that actually makes sense.

Table of Contents

A record-breaking retail rush

Steep discounts and aggressive digital marketing across major retail categories drove Americans’ Black Friday spending. Electronics, toys, and apparel saw some of the deepest price cuts of the season. Retailers leaned heavily on email campaigns, app notifications, and AI-powered product recommendations to push shoppers toward limited-time deals.

This one-day surge was only part of a larger trend. Across the five-day period from Thanksgiving through Cyber Monday, U.S. shoppers spent $44.2 billion online, according to Adobe data.

A few behaviors stood out:

- More shoppers waited for steep discounts rather than spreading purchases over November.

- Mobile shopping set new highs, with more than half of purchases completed on phones.

- AI-powered deal alerts and shopping tools played a bigger role than ever before, driving consumers directly to the lowest-priced items.

- Buy now, pay later (BNPL) usage increased, offering flexibility at a time when our budgets are stretched.

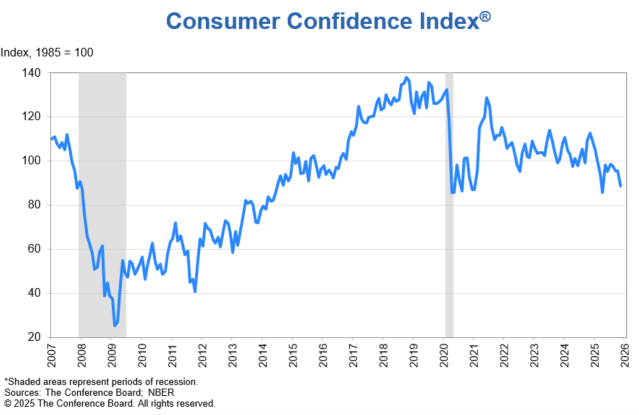

Consumer confidence moves in the opposite direction

Despite those spectacular sales figures, consumer sentiment was overwhelmingly negative. Around the same time the shopping records were being set, The Conference Board released its Consumer Confidence Index, which fell in November:

The index dropped to 88.7 from 95.5 the previous month, marking the lowest reading since April. The decline was driven by serious anxieties regarding the economy, including:

- Sluggish job gains and job worries.

- High costs and persistent inflation.

- The fallout from the recent government shutdown compounded financial worries for many Americans.

This dip in confidence wasn’t limited to lower-income households, either. A separate Harris Poll highlighted that one in three Americans earning six-figure incomes feels financially stretched. This shows us that stress is reaching far beyond the margins.

Economists widely noted that the Expectations Index (the blue line in the chart below), based on consumers’ short-term outlook for income, business, and labor market conditions, remained below the critical threshold of 80. This historically signals a recession ahead.

3 ways to explain the economic paradox

How can consumers set spending records while overall confidence drops to a seven-month low? Economists say the two trends can move in different directions because today’s economy is split. Some households are doing well and spending freely, while others are feeling the strain.

These factors help explain how both things can be true at the same time:

1. Higher prices inflate totals

Record sales don’t necessarily mean people are buying more. While spending on Black Friday grew by an estimated 9.1%, consumers purchased 2% fewer items, according to Salesforce. The culprit? Average selling prices grew 7%.

In other words, higher prices, especially for electronics and household goods, are inflating the total, even as shoppers put fewer products in their carts.

2. Higher-income households drive spending

Recent economic research suggests that wealthier Americans, less concerned by job worries and inflation, are driving a disproportionate share of consumer spending.

3. More shoppers rely on credit, BNPL

For many households, the surge in spending is funded not by cash reserves but by borrowed money. The holiday season arrived amid rising credit card debt and increasing delinquencies on short-term loans.

More shoppers are turning to BNPL plans to finance purchases, allowing them to delay payments on gifts and other items. For the full month of November, BNPL spending increased by 9%, according to Adobe.

BNPL usage can create the appearance of strong spending even when households are feeling financially vulnerable.

What the spending surge means for consumers

Headlines about record-breaking holiday spending can create subtle pressure, making it seem like everyone else is buying freely and you should too. But national numbers rarely reflect personal financial realities. For households trying to stay on budget, these big totals are a reminder to stay intentional instead of reacting to flashy deals.

Here are our practical takeaways from this year’s holiday spending trends.

1. Budgeting beats “deal” mentality

Retailers often use big discounts to trigger urgency, but a good deal only matters if the purchase fits your plan. A TV marked down 40% is still a full cost to you if it wasn’t something you needed.

Shoppers who stay on track usually set a firm spending limit before browsing, no matter how impressive the markdowns look.

2. BNPL can help, but it can hide your total spending

BNPL services are growing because they split payments without upfront interest. The catch is that using multiple plans across several stores makes it hard to see your true monthly obligation. One $50 payment feels small, but five or six of them can quickly stretch a budget once January arrives.

3. Practical gifts can help you stick to your budget

Economic stress doesn’t stop people from spending, but it changes what they buy. Data suggests shoppers are choosing value-focused or experience-based gifts over luxury items.

Many families are openly setting spending limits and focusing on thoughtful, manageable presents rather than high-ticket gifts that create financial strain.

4. January financial hangover is a real risk

Holiday travel, credit card bills, and BNPL installments often hit at the same time in early January. With credit card interest rates still high, carrying a balance into the new year is more costly than before.

That’s why it’s worth planning your January budget now to avoid starting 2026 in a financial hole.

Bottom line

During the 2025 holiday season, shoppers are pursuing value, leaning on flexible payment options, and navigating economic uncertainty with a mix of caution and determination.

For us as consumers, the takeaway is clear: Holiday shopping can still be joyful and affordable with planning and awareness. But as we move into 2026, this tension between spending behavior and financial anxiety may be one of the most important trends to watch.

Recommended readings

- Grocery Prices Up 30% Since 2020: What That Means for Your Thanksgiving Table

- When Safety Nets Fray: $411 Million in Shutdown Relief and the Future of Food Assistance

- Gen Z Credit Scores Drop to 676, Lowest of Any Generation in 2025

Article sources

At LendEDU, our writers and editors rely on primary sources, such as government data and websites, industry reports and whitepapers, and interviews with experts and company representatives. We also reference reputable company websites and research from established publishers. This approach allows us to produce content that is accurate, unbiased, and supported by reliable evidence. Read more about our editorial standards.

- Adobe, 2025 Holiday Shopping Trends

- CBS News, U.S. Consumers Spent a Record $11.8 Billion Online During Black Friday Sales

- CNBC, Holiday Shopping Turnout Jumps to 202.9 Million People During Thanksgiving Weekend, NRF Says

- NBC News, Black Friday Shoppers Spent Billions Despite Wider Economic Uncertainty

- The Conference Board, Consumer Confidence Survey

- Marketplace, Nearly Half of U.S. Retail Spending Comes From Top 10% of Earners

About our contributors

-

Written by Ben Luthi

Written by Ben LuthiBen Luthi is a Salt Lake City-based freelance writer who specializes in a variety of personal finance and travel topics. He worked in banking, auto financing, insurance, and financial planning before becoming a full-time writer.

-

Edited by Kristen Barrett, MAT

Edited by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.