Best for No Cosigners

Private Student Loans

- Specializes in no-cosigner student loans for undergraduates

- Eligibility is based on academic performance and projected future earnings

- Assigned a dedicated loan officer for support

- 0.50% rate discount for choosing the interest-only repayment option

- You must begin making payments while enrolled in school

| Rates (APR) | 7.49% – 12.99% |

| Loan amounts | $3,001 – $20,000 per year |

| Repayment terms | 10 years |

Funding U offers private student loans without requiring a cosigner—making it a standout option for students who can’t qualify with traditional lenders.

Unlike most student loan providers, Funding U bases approval on your academic performance and projected future earnings, not your credit score or income.

Similarly focused lenders are Edly and Ascent, but Funding U earns our top rating for no-cosigner undergraduate student loans. In this review, we’ll break down who Funding U is best for, how it works, and how it stacks up against similar lenders in 2025.

Table of Contents

What is Funding U?

Funding University, Inc., best known as Funding U, is a private student loan lender that takes a fresh approach to lending: no cosigners, no credit score requirements—just a strong focus on your academic potential. Founded in 2015, the company was built on the idea that students shouldn’t be penalized for having a limited credit history or lacking access to a qualified cosigner. Instead, Funding U assesses your grades, course load, and graduation likelihood to determine eligibility.

Loans are available to undergraduate students attending four-year, nonprofit colleges full-time in one of 38 eligible states. U.S. citizens, permanent residents, and DACA recipients can apply, and all loans come with fixed interest rates for predictable repayment.

Borrowers can prequalify with a soft credit check and receive funds disbursed to their school. With its academic-first underwriting model, Funding U aims to expand access to higher education, one no-cosigner loan at a time.

Who Funding U is best for

Funding U is best for undergraduate students who need financial aid but can’t rely on a cosigner. If you have limited credit history—or none at all—but are performing well in school and on track to graduate, you’re an ideal candidate. This lender is also a strong fit for DACA recipients and students who are ineligible for federal loans or traditional private loans due to citizenship or income restrictions.

Because Funding U doesn’t offer loans for part-time students, graduate degrees, or summer terms, it’s primarily suited to full-time undergrads attending four-year nonprofit colleges. And while you’ll need to make modest in-school payments, the trade-off is access to financing that rewards academic effort instead of credit history.

Funding U rates, terms, and fees

Due to its commitment to simplicity, Funding U’s no-cosigner undergraduate loans come with less flexibility than other lenders in terms of loan amounts and repayment options.

| Feature | Details |

| Fixed rates (APR) | 6.99% – 12.99% |

| Rate discounts | 0.50% for making interest-only payments |

| Loan amounts | $3,001 – $20,000 per academic year |

| Fees | Late payment |

Eligibility requirements

Funding U’s mission is to provide students with the means to finance their education based on their merits and future potential. This makes it more accessible to borrowers without a cosigner, but its state availability is limited.

| Eligibility requirements | Details |

| Citizenship | U.S. citizens, permanent residents, or DACA recipients |

| State of residence | Available in 38 states (listed below) |

| Minimum age | 18 years |

| School | 4-year accredited not-for-profit colleges in the U.S. |

| Enrollment status | At least half-time |

| Credit score | Not applicable |

| Income | Not applicable |

Repayment options and examples

All Funding U loans are repaid over a 10-year term following the six-month grace period, which begins after you graduate or drop below half-time enrollment. Borrowers must make payments while enrolled in school. This includes either flat $20 payments or interest-only payments each month.

Here’s what interest-only payments might look like for two loans:

| Loan amount | Rate | Monthly interest-only payment |

| $10,000 | 9.99% | $83.25 |

| $20,000 | 12.99% | $216.5 |

Here’s an example of a Funding U loan compared with a loan from a different student loan company that allows a 15-year term and allows the borrower to defer payments while in school:

| Funding U | Lender 2 | |

| Loan amount | $20,000 | $20,000 |

| Term | 10 years | 15 years |

| Rate | 9.99% | 9.99% |

| In-school repayment | $20/month (24 months) | $0 |

| Balance at start of repayment | $19,520 | $20,000 |

| Monthly payment after school | $252.90 | $209.12 |

| Total repayment | $30,348 | $37,641.60 |

Funding U’s required in-school payments reduce your balance early, saving you money over time. However, if cash flow is tight while in school, a lender that allows full deferment may be a better fit.

How Funding U compares to other lenders

To better understand Funding U’s position in the no-cosigner student loan market, we’ve compared it to competitors Ascent and Edly.

| Feature | Funding U | Ascent | Edly |

| LendEDU rating | 4.7/5 | 4.4/5 | 3.9/5 |

| Best for | No-cosigner loan | Deferred repayment | Income-based repayment |

| Rates (APR) | 6.99% – 12.99% | 9.46% – 15.88% | % of income |

| Cosigner required | ❌ No | ✅ Optional | ❌ No |

| Credit-based approval | ❌ No | ✅ Yes* | ❌ No |

| Loan type | Fixed rate only | Fixed & variable | Income-based |

| In-school repayment | Required | Optional | Optional |

| Available in | 38 states | All 50 states | Varies** |

| Loan amounts | $3K – $20K | $2K – $200K | $5K – $15K |

| Repayment terms | 10 years | 5 – 15 years | Not disclosed |

| Grace period | 6 months | 9 months | 4 months |

*Ascent offers a credit-based no-cosigner loan, but its outcomes-based no-cosigner loan is not credit-based. **Edly loans are only available for select programs at approved schools.

We generally think Funding U is the best no-cosigner loan on the market, but Ascent and Edly offer two additional solid options if you’re not in a state where Funding U is available, need to borrow more than Funding U’s max, or can’t make payments while in school.

Pros and cons of Funding U loans

Pros

-

No cosigner required—ideal for independent students.

-

Approval is based on academic performance and projected earnings, not credit scores.

-

Offers a 0.50% interest rate discount for interest-only in-school payments

-

Fixed interest rates provide repayment predictability.

-

Works with DACA recipients and permanent residents.

Cons

-

Only available in 38 states.

-

Lower maximum loan amount compared to many competitors.

-

Only one repayment term (10 years) and limited flexibility.

-

In-school payments required; no full deferment option.

-

No graduate or summer term loans available.

Is Funding U legit?

Yes, Funding U is a legitimate private student loan provider focused on no-cosigner undergraduate loans. It is not BBB-accredited but has an A+ rating and no complaints. Its academic-based underwriting model is unique among lenders.

Customer service and loan servicing

Funding U doesn’t list a phone number or online chat that can be used to contact its team. You can reach out via email at [email protected].

All loans are serviced by Scratch Services for management and communication related to repayment.

How to apply for a Funding U loan

Compared to other lenders, the application process with Funding U is streamlined. Since Funding U focuses on no-cosigner loans, you only need to provide your information.

Here’s a step-by-step guide to apply for a student loan from Funding U:

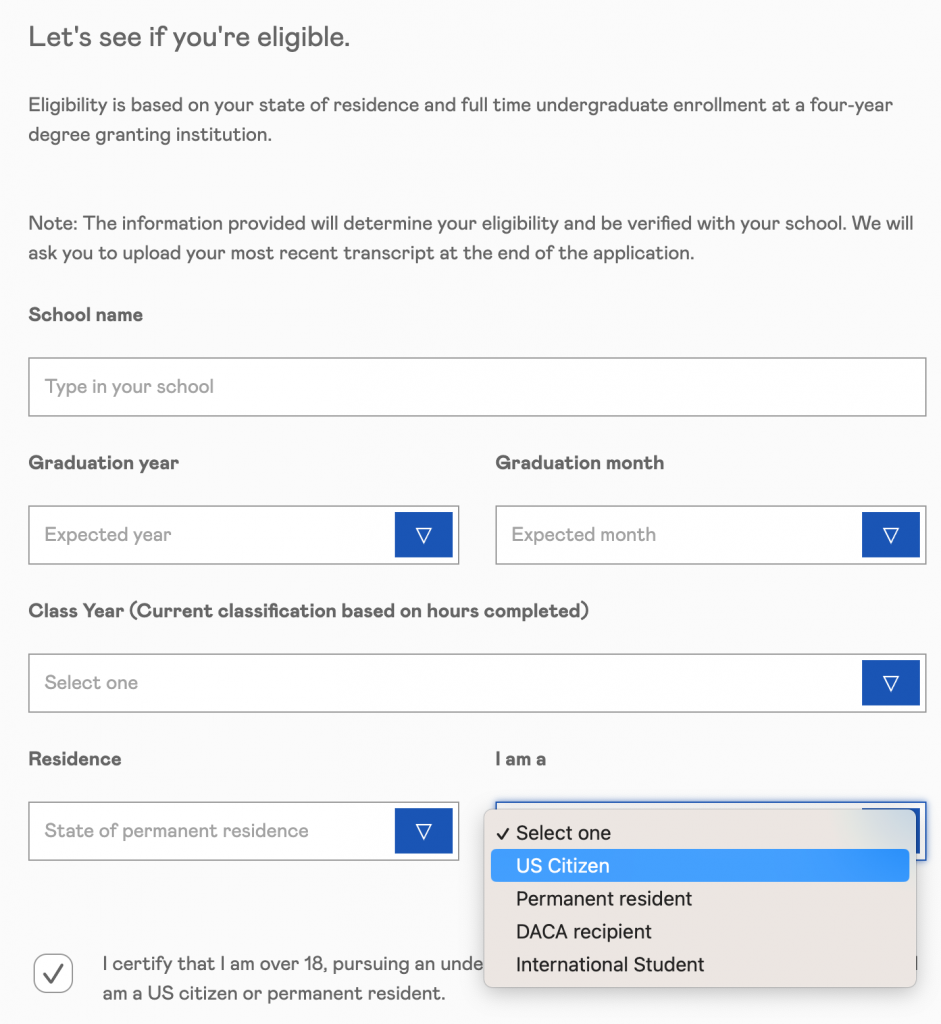

Step 1: Check your eligibility

Start by clicking “Apply Now” on the website to determine your eligibility.

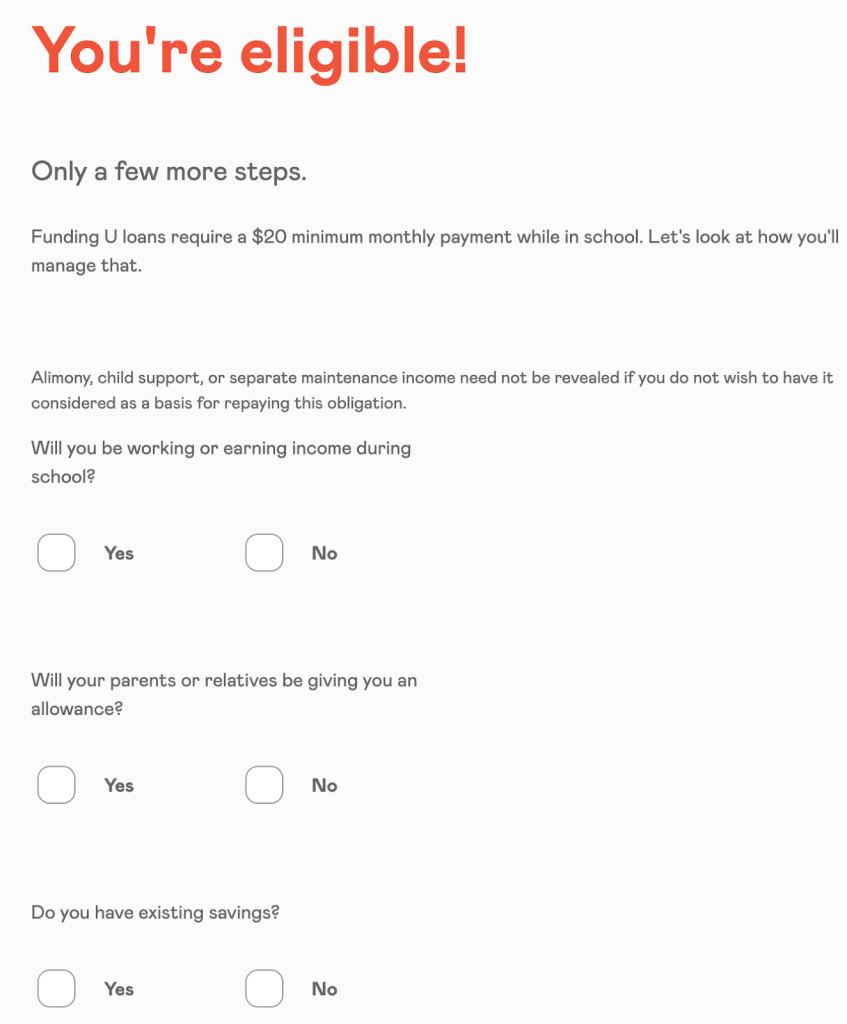

You’ll enter essential information about your school, grades, major, state of residence, and how you plan to make the minimum required in-school payments. This only takes a few minutes.

Once Funding U determines you’re eligible for a loan, it will prompt you to advise how much you want to borrow and agree to a credit check as part of the preapproval process,

Step 2: Get preapproved

After submitting your application, you should hear back within a few days. You’ll now provide your verification documents, including:

- A state-issued ID

- Your most recent full transcript

- Your financial aid award letter

- Your tuition bill

You’ll also get in touch with your dedicated loan officer.

Step 3: Sign the final documents

You’ll receive and sign your final loan documents to complete the process. Following final approval, Funding U disburses the funds to your school and applies them evenly across that year’s remaining terms. For instance, if you apply in the fall, it will disburse half the funds for the fall and half for the spring term.

How we rated Funding U student loans

We designed LendEDU’s editorial rating system to help readers find companies that offer the best student loans. Our system awards higher ratings to companies with affordable solutions, positive customer reviews, and online transparency of benefits and terms.

We compared Funding U to several student loan lenders, using hundreds of data points from company websites, public disclosures, customer reviews, and direct communication with company representatives. We weighted, scored, and combined each factor to produce a final editorial rating. This rating is expressed on a scale from 1 to 5, with 5 being the highest possible score. Our take is represented in our rating and best-for designation, recapped below.

| Company | Best for… | Rating (0-5) |

|---|---|---|

| Best No-Cosigner Loan |

FAQ about Funding U loans

Does Funding U do a hard credit check?

Funding U uses a soft credit check for prequalification and does not factor your FICO score into approval. A hard credit check may occur later in the application, but it does not play a major role in eligibility.

How long does Funding U take to process loans?

It typically takes a few business days for preapproval and several additional days to finalize documentation and funding. The full process may take one to three weeks, depending on your responsiveness and your school’s disbursement timeline.

Can I reapply if I get denied?

Yes, you can reapply for a Funding U loan. The lender will notify you of the denial reason, and if your information changes—such as grades or school status—you can submit a new application.

Are Funding U loans forgivable?

No, Funding U loans are private and do not qualify for federal forgiveness programs. You are responsible for full repayment unless you refinance or the lender offers hardship relief.

About our contributors

-

Written by Kristen Barrett, MAT

Written by Kristen Barrett, MATKristen Barrett is a managing editor at LendEDU. She lives in Cincinnati, Ohio, with her wife and their three senior rescue dogs. She has edited and written personal finance content since 2015.