Home equity lines of credit (HELOCs) and home equity agreements (HEAs) are two of the most popular ways to tap into your home’s value, but they work differently.

A HELOC lets you borrow against your equity with a revolving credit line. An HEA allows you to receive cash in exchange for a share of your home’s future value.

To show how the two options compare in practice, we’ve highlighted Figure, our choice for the highest-rated HELOC provider, and Hometap, our team’s top-rated HEA company. Here’s how these products stack up side by side:

View Rates

View Rates

|

View Rates

View Rates

|

|

| Product | Home equity line of credit (HELOC) | Home equity agreement (HEA) |

| Product | Product | |

| Home equity line of credit (HELOC) | Home equity agreement (HEA) | |

| Funding amounts | $20,000 – $750,000 | $15,000 – $600,000 |

| Funding amounts | Funding amounts | |

| $20,000 – $750,000 | $15,000 – $600,000 | |

| Term length | 5, 10, 15, or 30 years | 10 years |

| Term length | Term length | |

| 5, 10, 15, or 30 years | 10 years | |

| Min. credit score | 640 (720+ preferred) | 600 |

| Min. credit score | Min. credit score | |

| 640 (720+ preferred) | 600 | |

| State availability | 46 states (incl. D.C.) | 16 states |

| State availability | State availability | |

| 46 states (incl. D.C.) | 16 states | |

| See the best HELOCs and the best HEA companies | ||

Table of Contents

Hometap vs. HELOC: How they work

A home equity line of credit (HELOC) is a revolving line of credit secured by your home’s value. HELOCs have a draw period in which you can access your credit line, followed by a repayment period in which you’ll pay back what you borrowed with interest. Your HELOC may have a fixed or variable interest rate.

A home equity agreement, like the one you can get from Hometap, allows you to withdraw some of your equity in cash. In exchange, you agree to pay back the amount you withdraw, plus a percentage of your home’s appreciation, at a future date. Home equity agreements are not loans, so there are no monthly payments or interest.

Here are several important points to know:

| HEA | HELOC |

| No interest | Interest (Variable is most common); Figure’s rates are fixed and range from 8.35% – 16.55% |

| Repayment due in a lump sum (Hometap requires repayment after 10 years) | Draw period followed by repayment period (Figure’s draw period is 2 – 5 years, and its repayment period could be 5 – 30 years) |

| Withdraw up to $600,000 (Hometap) | Borrow $20,000 to $750,000 (Figure) |

| Funding typically take 3 weeks (Hometap) | Funding typically take 2 – 6 weeks |

| Upfront investment fee of 4.5% (Hometap) | No-fee HELOCs are available (FourLeaf Credit Union) |

| Hometap accepts automated valuations to determine home value instead of in-person appraisal | Some companies require full appraisal; Figure allows automated valuations |

| Lower min. credit score requirements | Higher min. credit score requirements |

| More limited availability | Many HELOC lenders are available in all 50 states |

Hometap vs. HELOC repayment

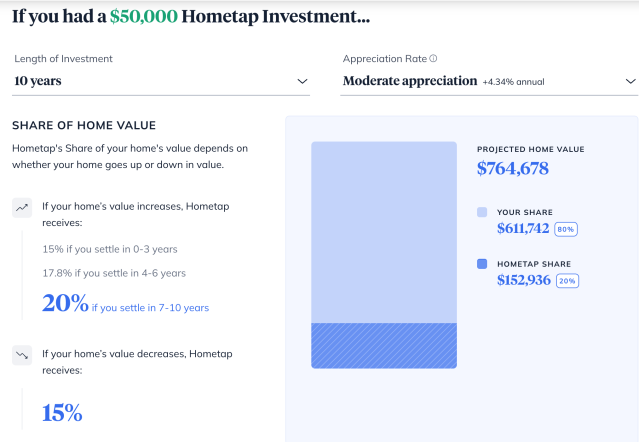

The example below from Hometap shows how you might owe Hometap $152,936 in equity after 10 years, assuming moderate appreciation:

In the table below, you can see monthly payments and the total cost of a $50,000 HELOC (for simplicity, we assumed a fixed 7.50% interest rate) with repayment terms of 10, 20, and 30 years:

| Terms | Monthly payment | Total cost of repayment (incl. principal and interest) |

| 10-year draw / 10-year repayment | $312.50 (draw) / $593.51 (repayment) | ~$108,721 |

| 10-year draw / 15-year repayment | $312.50 (draw) / $463.51 (repayment) | ~$120,930 |

| 10-year draw / 20-year repayment | $312.50 (draw) / $402.80 (repayment) | ~$134,170 |

The cost of HEA repayment is notably difficult to predict, but in these examples, a HELOC would cost less, even if you chose the longest repayment term.

Hometap vs. HELOC: Eligibility requirements

Is it easier to get approved for a HELOC or a home equity agreement? Requirements for both products typically include:

- Credit score

- Debt-to-income ratio (DTI)

- Loan-to-value ratio (LTV)

- Employment status

- Property type

DTI measures how much of your monthly income goes to debt repayment each month. LTV compares the amount of equity being borrowed or withdrawn to your home’s appraised value.

Here’s what you’ll need to qualify with Figure versus Hometap, side by side.

| Figure | Hometap | |

| Min. credit score | 640 (720+ preferred) | 600 |

| Max. DTI | 50% | None |

| Max. LTV | 95% | 75% |

| Employment requirements | Must be employed, self-employed, or retired | None |

| Eligible properties | Single-family residences, townhomes, planned urban developments, most condos | Single-family, condos or apartments, multi-family homes with 1 – 4 units, and manufactured homes |

| State availability | Available in 45 U.S. states and Washington, D.C. | Available in: AZ, CA, DC, IN, FL, MI, MN, MS, NV, NJ, NY, NC, OH, OR, PA, SC, UT, VA, and WA |

Between the two, Hometap offers an easier path to withdrawing equity. You don’t need perfect credit or a low DTI, and employment history isn’t a factor. However, you will need a larger share of equity in your home to get approved and live in an eligible state.

When to choose Hometap or a HELOC

| If you… | Winner |

| Prefer predictability | HELOC |

| Want a simplified application | HELOC |

| Have a good credit score (720+) | HELOC |

| Want to withdraw smaller amounts over time rather than a lump sum | HELOC |

| Would like to avoid monthly payments | Hometap |

| Can’t meet traditional HELOC requirements | Hometap |

| Want to avoid credit score impacts | Hometap |

Predictability

HELOCs tend to offer more predictability, with a fixed-rate HELOC (like Figure) being the most straightforward way to calculate your repayment cost. With a home equity agreement, you may not know exactly what you’ll need to repay until the agreement expires. That could lead to an unpleasant surprise if you’re not ready to make a large balloon payment.

Winner: HELOC (Figure)

Application process

Applying for a HELOC or HEA shouldn’t be a headache. A HELOC with a simple online application process (like Figure’s) can help speed things along and save time since you don’t need to meet face-to-face. Ideally, you should be able to submit your application and supporting documents from the comfort of your home in five minutes or less.

Winner: HELOC (Figure)

Credit score

If you have a credit score of 720 or better and your home appreciates moderately, a HELOC could end up costing you less than an HEA. (You’ll repay the same amount for your HELOC regardless of your home value.)

Winner: HELOC (Figure)

Smaller withdrawals

Many variable-rate HELOCs work more like credit cards, allowing you to borrow as needed against the credit line during the draw period. A traditional HELOC (like the one from our pick for the best credit union, FourLeaf) can offer plenty of flexibility.

Winner: HELOC (FourLeaf FCU)

Monthly payments

Adding a new debt payment to the mix can strain your budget that you may prefer to avoid. Even if your HELOC payment is low, a change to your income could put your ability to cover the bills at risk. Home equity agreements, meanwhile, don’t require monthly payments, so you won’t need to worry about an impact on your cash flow.

Winner: Hometap HEA

Approval requirements

Any time you get a loan, you can expect a lender to consider your credit score, income, and other financial details. Poor credit, high debt, or limited work history could all be obstacles to getting a HELOC. Home equity agreements, focus more on how much equity you have and your home’s future value for approval.

Winner: Hometap HEA

Credit impact

Home equity agreements are not considered loans, so they don’t show up on your credit reports the way a HELOC would. You may see a new credit inquiry on your credit reports when you apply for one, but otherwise, having a home equity agreement doesn’t pose a risk to your credit. And again, perfect credit isn’t required to get approved for one.

Winner: Hometap HEA

How we rated Figure and Hometap

We designed LendEDU’s editorial rating system to help readers find companies that offer the best home equity products. Our system awards higher ratings to companies with affordable solutions, positive customer reviews, and online transparency of benefits and terms.

We compared Figure and Hometap to several home equity companies, using hundreds of data points from company websites, public disclosures, customer reviews, and direct communication with company representatives. We weighted, scored, and combined each factor to produce a final editorial rating. This rating is expressed on a scale from 1 to 5, with 5 being the highest possible score. Our take on each company is represented in our ratings and best-for designations, recapped below.

| Company | Best for… | Rating (0-5) |

|---|---|---|

| Best HELOC | ||

| Best HEA |

About our contributors

-

Written by Rebecca Lake, CEPF®

Written by Rebecca Lake, CEPF®Rebecca Lake is a certified educator in personal finance (CEPF®) and freelance writer specializing in finance.

-

Reviewed by Chloe Moore, CFP®

Reviewed by Chloe Moore, CFP®Chloe Moore, CFP®, is the founder of Financial Staples, a virtual, fee-only financial planning firm based in Atlanta, Georgia, and serving clients nationwide. Her firm is dedicated to assisting tech employees in their 30s and 40s who are entrepreneurial-minded, philanthropic, and purpose-driven.