Best for Excellent Credit

Our take: LightStream offers plenty to like, including low rates, a $100 satisfaction guarantee, and the Rate Beat Program. It’s one of the most affordable personal loan options available if you qualify. But LightStream doesn’t offer a soft credit check for prequalification, so it’s best if you’re confident in your credit profile. If you’re unsure whether you’ll be approved or you prioritize customer service, a lender like SoFi may be a better fit.

Personal Loans

- Low starting rates for qualified borrowers

- No fees or prepayment penalties

- Rate Beat Program and $100 Experience Guarantee

- Same-day funding available

- Joint loans allowed

- No prequalification option

- Not available to fair-credit borrowers

- Limited servicing flexibility and email-only customer support

| Fixed rates (APR) | 7.99%% – 25.49%%, varies by loan type and credit profile |

| Loan amounts | $5,000 – $100,000 |

| Repayment period | 2 – 12 years |

| Min. credit score | 660 |

LightStream personal loans are designed for borrowers with excellent credit, and the rates reflect it. Backed by Truist Bank, LightStream offers some of the lowest starting APRs in the market, with no fees, same-day funding, and a fully online application. But there’s no prequalification option, so you’ll need to be confident in your credit before applying.

In this review, we’ll break down LightStream’s rates, terms, eligibility requirements, and standout features like its Rate Beat Program and Experience Guarantee.

Table of Contents

- LightStream personal loans

- Home Improvement / Pool / Solar Loan

- Credit Card / Debt Consolidation Loan

- New Auto Purchase Loan

- Used Auto Purchase From Dealer Loan

- Used Auto Purchase From Individual Loan

- Auto Lease Buyout Loan

- Auto Loan Refinance

- Boat / RV / Aircraft Purchase or Refinance Loan

- Motorcycle Purchase or Refinance Loan

- Timeshare / Fractional Purchase or Refinance Loan

- PreK–12 Education Loan or Refinance

- Other Loan

- Requirements

- Pros and cons

- Alternatives

- Reviews and reputation

- How to apply

LightStream personal loans at a glance

| Term | Details |

| Minimum credit score | 660 |

| Fixed rates (APR) | 7.99%% – 25.49%%, varies by loan type and credit profile |

| Rate discounts | 0.50% for enrolling in autopay at loan application |

| Loan amounts | $5,000 – $100,000 |

| Repayment period | 2 – 12 years |

| Unsecured or secured? | Unsecured |

| Joint loans? | Yes |

| Time to funding after approval | As soon as same day |

| Fees | None |

A few standout features of LightStream loans are:

- Rate Beat Program: If you’re approved for an unsecured loan elsewhere, LightStream will beat the competitor’s APR by 0.10 percentage points.

- Experience Guarantee: If you’re not satisfied with your loan experience, LightStream will send you $100.

- No fees, ever: There are no origination fees, late fees, or prepayment penalties.

Here’s a look at how LightStream loans break down by purpose.

Home Improvement / Pool / Solar Loan

Rates starting at: 6.99% APR

These loans offer the option to schedule when you receive your funds, anytime within 90 days of approval. This can make them ideal for planning larger projects. Rates are typically among LightStream’s lowest. During the application, you’ll need to specify the exact purpose.

Credit Card / Debt Consolidation Loan

Rates starting at: 7.24% APR

Designed to help pay off higher-interest balances, this loan option may come with slightly different terms or rates than home improvement loans. As with all LightStream loans, there are no balance transfer fees.

New Auto Purchase Loan

Rates starting at: 6.49% APR

You can use LightStream to finance the purchase of a new car from a dealership. This offers an alternative to dealer financing, with no down payment requirement and potentially better terms.

Used Auto Purchase From Dealer Loan

Rates starting at: 6.49% APR

If you’re buying a used car from a dealer, this loan option may come with a slightly higher rate than new car financing. Still, rates are typically lower than traditional used car loans from other lenders.

Used Auto Purchase From Individual Loan

Rates starting at: 6.74% APR

Planning to buy a used vehicle from a private seller? This option allows you to borrow directly and pay the seller, avoiding third-party financing arrangements.

Auto Lease Buyout Loan

Rates starting at: 6.74% APR

You can finance the full buyout cost of your leased vehicle with LightStream. This option is popular for borrowers who want to own their car at lease-end without dealer markups.

Auto Loan Refinance

Rates starting at: 6.74% APR

Refinance your existing auto loan with no fees and potentially lower interest. This can be a good fit for borrowers whose credit has improved since their original loan.

Boat / RV / Aircraft Purchase or Refinance Loan

Rates starting at: 6.49% APR

LightStream allows you to finance large recreational purchases or refinance existing loans on boats, RVs, or even aircraft. Loan amounts and terms vary, and you must use the funds as specified.

Motorcycle Purchase or Refinance Loan

Rates starting at: 6.49% APR

Buy a new or used motorcycle or refinance an existing bike loan. You’ll get the same low-rate, no-fee structure as LightStream’s other personal loans.

Timeshare / Fractional Purchase or Refinance Loan

Rates starting at: 8.24% APR

This option covers the cost of a new timeshare, fractional ownership, or refinancing an existing one. Like other options, it requires you to certify that the loan will be used for this purpose.

PreK–12 Education Loan or Refinance

Rates starting at: 8.24% APR

Use this loan to cover private school tuition or refinance a loan you took out for PreK–12 education costs. Note that student loans for college or higher education are not allowed.

Other Loan

Rates starting at: 8.24% APR

If your need doesn’t fit any of the above categories, you can apply under the “Other” category. However, be aware that rates may vary based on your description and loan purpose.

LightStream personal loan requirements and application

LightStream only approves applicants with good to excellent credit. If your credit profile has any recent delinquencies, limited history, or a high debt-to-income ratio, you’re unlikely to qualify.

| Requirement | Details |

| Residency | Must be a U.S. citizen or permanent resident |

| State of residence | All 50 states |

| Minimum credit score | 660 |

| Income | Must be sufficient to support loan payments |

| Joint applications | Allowed |

LightStream also considers your:

- Credit history and payment patterns

- Income and assets

- Debt-to-income ratio

- Stability (such as employment and housing)

Unlike many competitors, LightStream does not offer prequalification. Submitting an application triggers a hard credit inquiry, which could lower your credit score by a few points.

Pros and cons of LightStream

Pros

-

Super low rates for excellent-credit borrowers

-

No fees, ever

No origination, late, or prepayment fees

-

Rate Beat Program will beat competitor APRs by 0.10%

-

Experience Guarantee gives you $100 if you’re not satisfied

-

Same-day funding available via wire transfer

-

Fully online application and loan process

-

Joint applications allowed

Cons

-

No soft credit check for prequalification

-

Not suitable for fair- or bad-credit borrowers

-

Customer service limited to email

No phone support

-

Strict servicing rules

No due date changes, no same-day payments

-

Rates vary by loan purpose, which can be confusing

LightStream alternatives

Here’s how LightStream stacks up with three other top-rated personal loan lenders:

LightStream vs. Upstart

Upstart is a better option if you have limited or poor credit. It accepts applicants with credit scores as low as 300 (the lowest possible) and uses alternative underwriting criteria, like education and employment history, to evaluate risk. That makes it far more accessible. Choose LightStream if you qualify for its lower rates, but Upstart could work well if you’re still building credit.

LightStream vs. Upgrade

Upgrade is ideal for borrowers with fair credit (minimum score of 580) or those who want more customer service flexibility. Unlike LightStream, Upgrade offers phone support and doesn’t require a hard credit pull to check your rate. If you don’t meet LightStream’s stricter credit criteria or want a more transparent application process, Upgrade is an excellent alternative.

LightStream vs. SoFi

SoFi is the best alternative for borrowers with good credit who want strong customer support and member benefits. Like LightStream, SoFi offers large loan amounts (up to $100,000) and competitive rates.

You can prequalify with SoFi via a soft credit check, access live customer support, and even benefit from financial planning, referral bonuses, and more. If you’re looking for a more hands-on lender experience or aren’t sure you’ll be approved with LightStream, SoFi may be the better pick.

See our full list of reviewed personal loan lenders.

LightStream reviews and reputation: Is it legit?

LightStream is a division of Truist Bank, one of the largest financial institutions in the U.S. It’s accredited by the Better Business Bureau (BBB) and has an “A” rating with BBB. While the lender is legitimate and well-established, its customer service reviews are mixed at best.

| Source | Customer rating | Number of reviews |

| Trustpilot | 1.3/5 | 98 |

| Better Business Bureau | 1.41/5 | 61 |

What customers like:

- Fast funding and easy online process

- Great rates for those who qualify

- No surprise fees or hidden charges

What customers dislike:

- No phone support and slow email replies

- Strict payment policies and lack of flexibility

- Denials or poor experience despite good credit

Bottom line: If your loan goes smoothly, you may never need customer service. But if you run into issues, other lenders like SoFi or Upgrade may offer better support options.

LightStream customer service and contact info

LightStream offers email-only support for personal loan servicing. There’s no phone number listed for loan assistance.

| Contact method | Details |

| [email protected] | |

| Mailing address | P.O. Box 117320, Atlanta, GA 30368-7320 |

| Application hours | Monday – Friday: 10 a.m. – 6 p.m. Eastern |

How to apply for a LightStream personal loan

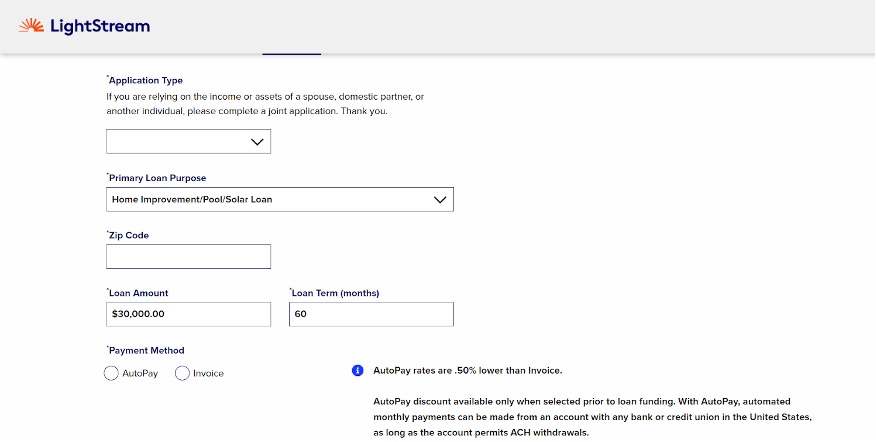

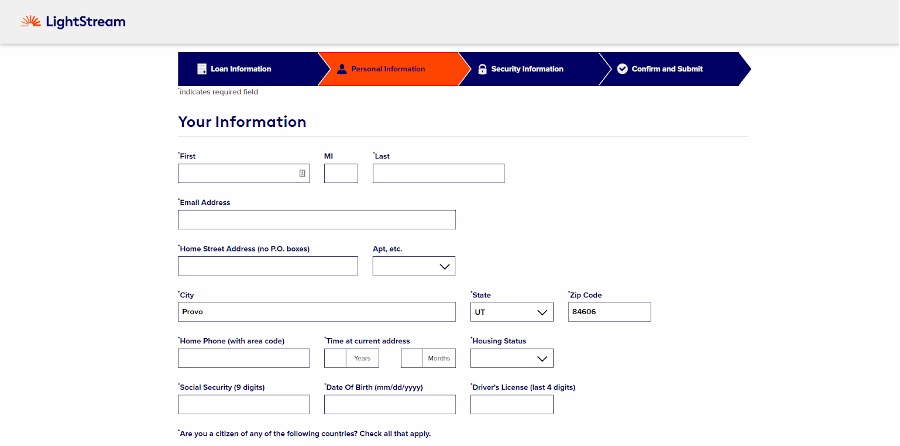

The application process is fully online and typically takes just a few minutes. You’ll need to:

- Choose your loan type. Select from LightStream’s branded loan purposes (e.g., Home Improvement, Debt Consolidation, Auto Refinance, etc.).

- Enter your details. You’ll provide your name, address, income, Social Security number, housing situation, and employment status.

- Pick your loan terms. Choose the amount, repayment term, and funding date. You’ll also select AutoPay (to get a 0.50% discount) or Invoice (if you prefer to set up payments manually later).

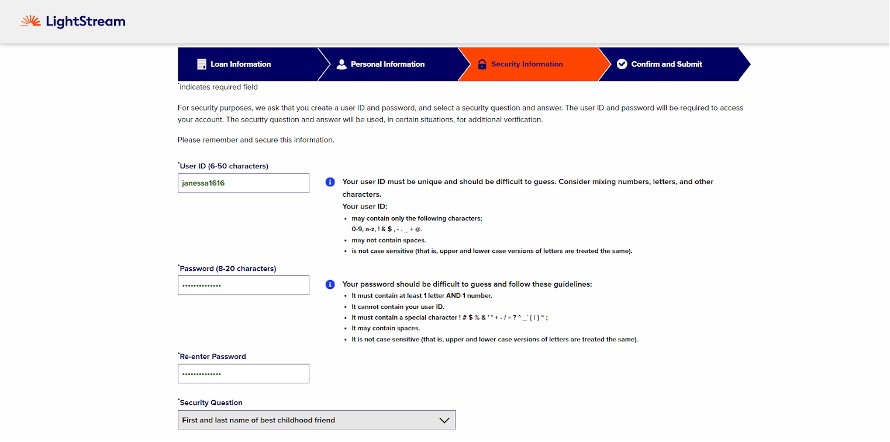

- Create a LightStream account. You’ll set a username, password, and security questions.

- Authorize a hard credit check. This is required before you can see your rates and loan options.

- Review and accept your loan. Once approved, you can select your loan offer and enter your funding preferences.

Funds can be deposited as soon as the same day if you complete the process early enough (typically before 2:30 p.m. Eastern and wire instructions submitted by 3 p.m.).

How we rated LightStream

We designed LendEDU’s editorial rating system to help readers find companies that offer the best personal loans. Our system awards higher ratings to companies with affordable solutions, positive customer reviews, and online transparency of benefits and terms.

We compared LightStream to several personal loan lenders, using hundreds of data points from company websites, public disclosures, customer reviews, and direct communication with company representatives. We weighted, scored, and combined each factor to produce a final editorial rating. This rating is expressed on a scale from 1 to 5, with 5 being the highest possible score. Our take is represented in our rating and best-for designation, recapped below.

| Company | Best for… | Rates (APR) | Rating (0-5) |

|---|---|---|---|

| Best for Excellent Credit | 7.99%% – 25.49%% |

About our contributors

-

Written by Alene Laney

Written by Alene LaneyAlene Laney is a personal finance writer specializing in mortgages, home equity, and consumer financial products. A credit card rewards enthusiast and mother of five, Alene enjoys sharing money-saving and money-making strategies.