- Receive up to $500K in cash

- No restrictions on how you use your funds

- No income or employment requirements

- Pre-qualify in 2 minutes

State Availability

Arizona, California, Colorado, Florida, New Jersey, Nevada, Ohio, Oregon, Pennsylvania, South Carolina, Tennessee, Utah, Virginia, and Washington

Min. Credit Score

500

Min. Home Equity Owned

30%

| Terms | Details |

|---|---|

| Rates (APR) | None |

| Funding | $50,000 — $500,000 |

| Funding time | 14 – 30 days |

| Term length | Up to 30 years |

Table of Contents

How Splitero Works

Founded in 2021, Splitero aims to redefine how homeowners tap into their equity without signing up for monthly payments.

Using what’s called a home equity investment (aka home equity sharing agreement or home equity agreement) model, Splitero gives you a lump sum upfront in exchange for a share of your home’s future value. When you sell your home or reach the end of your term, you repay Splitero based on that agreed-upon share.

- Funding amounts: $50,000 – $500,000 (up to 25% of home value)

- Term length: Up to 30 years (or until your first mortgage matures)

- Minimum credit score: 500

- Income requirements: None

No monthly payments

One of Splitero’s main selling points is that it offers a lump sum of cash with no monthly payments. Instead, you repay Splitero later—usually when you sell or refinance—based on an agreed share of your home’s appreciation.

Maturity match

Splitero gives you up to 30 years to repay the investment—much longer than the 10-year term most other HEI companies offer. This is sometimes called “maturity match” because it allows the agreement to align with your existing mortgage.

Live in your home, on your terms

You stay in full control of your home. You can renovate, refinance, or even pay off the agreement early without penalties. Splitero expects you to maintain the condition of your home, but it doesn’t monitor your maintenance or require regular inspections. Their phrasing—“live in your home, on your terms”—reflects this hands-off approach.

Flexible qualification requirements

To qualify, you’ll need at least 30% equity in your home and a credit score of 500 or higher. There are no income or employment requirements, which makes Splitero accessible for homeowners who are retired, self-employed, or between jobs.

Costs and fees

Splitero charges a 4.99% origination fee (minimum $1,500), plus escrow, title, and closing fees ($500 to $1,500), an appraisal fee ($200 to $700), and a state credit report fee. These are deducted from your payout rather than paid upfront.

Repurchase

To repurchase, you pay Splitero a lump sum based on its initial investment plus its agreed share of your home’s appreciation. You can buy back anytime within the term (up to 30 years) through refinancing, selling your home, or a cash buyout. There are no penalties for early repayment.

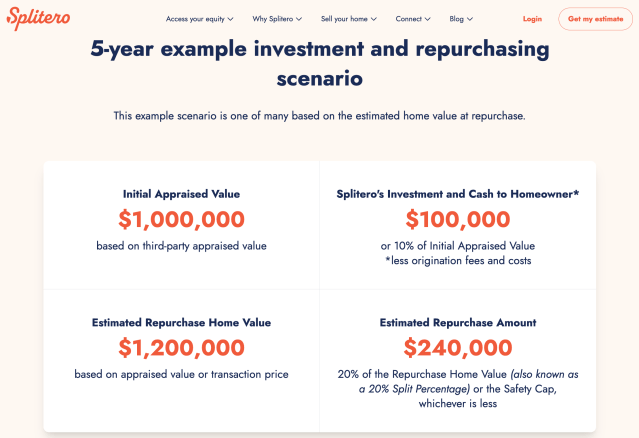

How is the final payment calculated?

Splitero appraises your home when you start and again at repurchase. Your payment equals its initial investment plus its share of your home’s appreciation. A 19.99% annual cap limits rapid appreciation costs. If your home loses value, Splitero shares in the depreciation.

The image below from Splitero’s website shows how a five-year investment could work out:

How does Splitero get funding?

Splitero is backed by major institutional investors. For example, in December 2024, Splitero secured a programmatic capital commitment of up to $350 million from funds managed by Blue Owl Capital’s Alternative Credit strategy. This funding supports Splitero’s ability to provide homeowners with lump-sum cash investments without monthly payments, expanding its capacity to help more homeowners access equity.

The partnership with Blue Owl also enabled Splitero to expand its services into Tennessee and Virginia, continuing its mission to make home equity accessible without debt obligations.

See more about Splitero’s recent funding news.

How does Splitero make money?

Splitero makes a profit by acquiring a percentage share of your home’s future appreciation. For instance, if your home’s value increases significantly, you’ll owe Splitero the original investment plus its share of that appreciation at the time of repayment.

Splitero news for 2025

In 2025, Splitero announced its expansion into five additional states to reach more homeowners. View Splitero’s press releases here.

Who’s eligible for a Splitero home equity investment?

To qualify:

| Properties | Owner-occupied only; no mobile homes or investment properties |

| State of residence | Limited (see table below) |

| Min. home equity | 30% equity retained (70% CLTV) |

| Min. credit score | 500 |

Is Splitero available in your state?

| State | Available? |

| Alabama | ❌ |

| Alaska | ❌ |

| Arizona | ✅ |

| Arkansas | ❌ |

| California | ✅ |

| Colorado | ✅ |

| Connecticut | ❌ |

| Delaware | ❌ |

| Florida | ✅ |

| Georgia | ❌ |

| Hawaii | ❌ |

| Idaho | ❌ |

| Illinois | ❌ |

| Indiana | ❌ |

| Iowa | ❌ |

| Kansas | ❌ |

| Kentucky | ❌ |

| Louisiana | ❌ |

| Maine | ❌ |

| Maryland | ❌ |

| Massachusetts | ❌ |

| Michigan | ❌ |

| Minnesota | ❌ |

| Mississippi | ❌ |

| Missouri | ❌ |

| Montana | ❌ |

| Nebraska | ❌ |

| Nevada | ✅ |

| New Hampshire | ❌ |

| New Jersey | ✅ |

| New Mexico | ❌ |

| New York | ❌ |

| North Carolina | ❌ |

| North Dakota | ❌ |

| Ohio | ✅ |

| Oklahoma | ❌ |

| Oregon | ✅ |

| Pennsylvania | ✅ |

| Rhode Island | ❌ |

| South Carolina | ✅ |

| South Dakota | ❌ |

| Tennessee | ✅ |

| Texas | ❌ |

| Utah | ✅ |

| Vermont | ❌ |

| Virginia | ✅ |

| Washington | ✅ |

| West Virginia | ❌ |

| Wisconsin | ❌ |

| Wyoming | ❌ |

| Washington, D.C. | ❌ |

Pros of Splitero

- No monthly payments: Unlike HELOCs or home equity loans, Splitero doesn’t require monthly payments, making it useful for homeowners with tight cash flow.

- No income or employment requirements: Eligibility is based on your home’s value and equity rather than your income.

- Low minimum credit score: At just 500, Splitero’s credit score requirement is accessible for those with fair or poor credit.

Cons of Splitero

- Lump-sum repayment required: Splitero requires repayment in one lump sum, either through sale, refinance, or cash buyout, with no partial payment options.

- No early payoff benefits: Competitors like Hometap offer adjustment options that can reduce costs if you repay early. Splitero does not.

- High fees: Expect to pay a 4.99% origination fee plus appraisal, title, and closing costs deducted from your funding amount.

- Limited availability: Currently available in only 14 states, making it inaccessible for many homeowners.

What is the downside to a home equity agreement?

The main downside is that you share a portion of your home’s future appreciation with the investor, which can cost more than a traditional loan if your home value rises significantly. See our full list of the pros and cons of a home equity agreement.

Alternatives to Splitero

If you live outside Splitero’s operating states or prefer an HEI with partial payment options, consider these top-rated alternatives:

Learn more in our guide to the best home equity agreements.

What HEIs are available in your state?

| State | Splitero | Hometap | Unlock | Point |

| Alabama | ❌ | ❌ | ❌ | ❌ |

| Alaska | ❌ | ❌ | ❌ | ❌ |

| Arizona | ✅ | ✅ | ✅ | ✅ |

| Arkansas | ❌ | ❌ | ❌ | ❌ |

| California | ✅ | ✅ | ✅ | ✅ |

| Colorado | ✅ | ❌ | ❌ | ✅ |

| Connecticut | ❌ | ❌ | ❌ | ✅ |

| Delaware | ❌ | ❌ | ❌ | ❌ |

| Florida | ✅ | ✅ | ✅ | ✅ |

| Georgia | ❌ | ❌ | ❌ | ✅ |

| Hawaii | ❌ | ❌ | ✅ | ✅ |

| Idaho | ❌ | ❌ | ✅ | ❌ |

| Illinois | ❌ | ❌ | ❌ | ✅ |

| Indiana | ❌ | ✅ | ✅ | ✅ |

| Iowa | ❌ | ❌ | ❌ | ❌ |

| Kansas | ❌ | ❌ | ❌ | ❌ |

| Kentucky | ❌ | ❌ | ✅ | ❌ |

| Louisiana | ❌ | ❌ | ❌ | ❌ |

| Maine | ❌ | ❌ | ❌ | ❌ |

| Maryland | ❌ | ❌ | ❌ | ✅ |

| Massachusetts | ❌ | ❌ | ❌ | ❌ |

| Michigan | ❌ | ✅ | ✅ | ✅ |

| Minnesota | ❌ | ✅ | ❌ | ✅ |

| Mississippi | ❌ | ❌ | ❌ | ❌ |

| Missouri | ❌ | ✅ | ✅ | ✅ |

| Montana | ❌ | ❌ | ✅ | ❌ |

| Nebraska | ❌ | ❌ | ❌ | ❌ |

| Nevada | ✅ | ✅ | ✅ | ✅ |

| New Hampshire | ❌ | ❌ | ✅ | ❌ |

| New Jersey | ✅ | ✅ | ✅ | ✅ |

| New Mexico | ❌ | ❌ | ✅ | ❌ |

| New York | ❌ | ✅ | ❌ | ✅ |

| North Carolina | ❌ | ❌ | ✅ | ❌ |

| North Dakota | ❌ | ❌ | ❌ | ❌ |

| Ohio | ✅ | ✅ | ✅ | ✅ |

| Oklahoma | ❌ | ❌ | ❌ | ❌ |

| Oregon | ✅ | ✅ | ✅ | ✅ |

| Pennsylvania | ✅ | ✅ | ✅ | ✅ |

| Rhode Island | ❌ | ❌ | ❌ | ❌ |

| South Carolina | ✅ | ✅ | ✅ | ✅ |

| South Dakota | ❌ | ❌ | ❌ | ❌ |

| Tennessee | ✅ | ❌ | ✅ | ✅ |

| Texas | ❌ | ❌ | ❌ | ❌ |

| Utah | ✅ | ✅ | ✅ | ✅ |

| Vermont | ❌ | ❌ | ❌ | ❌ |

| Virginia | ✅ | ✅ | ✅ | ✅ |

| Washington | ✅ | ❌ | ✅ | ✅ |

| West Virginia | ❌ | ❌ | ❌ | ❌ |

| Wisconsin | ❌ | ❌ | ❌ | ❌ |

| Wyoming | ❌ | ❌ | ✅ | ❌ |

| Washington, D.C. | ❌ | ✅ | ✅ | ✅ |

You might also want to consider other home equity products. Here’s how Splitero’s offer differs from other home equity options:

- vs. home equity loans: A home equity loan provides a lump sum based on your home’s equity but requires regular monthly payments with interest. In contrast, Splitero does not require monthly payments. Instead, you settle up at the end, making it more flexible for those who prefer no regular payments.

- vs. home equity lines of credit (HELOCs): A HELOC allows you to borrow against your home equity as needed, with variable interest rates and ongoing payments. Splitero’s model does not involve any monthly payments, making it a better fit for those looking to avoid monthly obligations.

- vs. cash-out refinance: A cash-out refinance involves replacing your mortgage with a new, larger loan, giving you the difference in cash. It often comes with new terms, potentially higher interest rates, and monthly payments. Unlike a cash-out refinance, Splitero provides cash without altering your mortgage.

- vs. reverse mortgages: Available for homeowners 62 and older, reverse mortgages provide payments based on your home’s equity but accrue interest and reduce the owner’s equity over time. Splitero’s model requires no repurchase or repayment until the end of the term or when you sell or refinance.

Splitero offers a unique alternative for those seeking to access their home equity without monthly payments, making it a flexible option compared to traditional home equity products.

Is Splitero legitimate?

| Source | Customer rating | Number of reviews |

| Trustpilot | 3.8/5 | 47 |

| Better Business Bureau | 3.54/5 | 13 |

Splitero holds an “A” rating with the BBB and earns decent but not excellent ratings on both platforms. Customers cite mixed experiences, praising helpful service but noting slow processing and communication challenges.

Is Splitero still in business?

Yes, Splitero is still in business as of mid-2025. It continues to expand operations, recently securing a $350 million capital commitment from Blue Owl Capital to support its growth and homeowner offerings.

Customer service

Yes; Splitero’s team is based in San Diego. Contact them at [email protected], or visit Splitero’s social media, including Facebook, Instagram, and LinkedIn.

How to apply

Check your eligibility online to prequalify without affecting your credit. Complete an application with your ID and mortgage info, await underwriting, and receive your funds via wire transfer. A full application triggers a hard credit inquiry.

FAQ

Is Splitero a good idea?

Splitero can be a good option for homeowners needing cash without monthly payments or traditional income verification. However, its high fees, lump-sum repayment, and limited state availability may not suit everyone.

Does Splitero do a credit check?

Yes, Splitero requires a minimum credit score of 500 but does not consider income or employment.

How we rated Splitero

We designed LendEDU’s editorial rating system to help readers find companies that offer the best home equity sharing agreements. Our system awards higher ratings to companies with affordable solutions, positive customer reviews, and online transparency of benefits and terms.

We compared Splitero to several home equity investment companies, using hundreds of data points from company websites, public disclosures, customer reviews, and direct communication with company representatives. We weighted, scored, and combined each factor to produce a final editorial rating. This rating is expressed on a scale from 1 to 5, with 5 being the highest possible score. Our take is represented in our rating and best-for designation, recapped below.

| Company | Best for… | Rating (0-5) |

|---|---|---|

| Best for Maturity Match |

About our contributors

-

Written by Amanda Hankel

Written by Amanda HankelAmanda Hankel is a managing editor at LendEDU. She has more than seven years of experience covering various finance-related topics and has worked for more than 15 years overall in writing, editing, and publishing.