Debt consolidation loans can help you get a better handle on what you owe and streamline your monthly payments. Some people use personal loans for debt consolidation, while others leverage their home’s value with a home equity loan or line of credit (HELOC).

The best debt consolidation loans allow you to borrow the amount you need at an affordable interest rate, with a repayment term that fits your budget. We researched the best debt consolidation companies and lenders so you can compare rates, terms, and eligibility in one place.

Table of Contents

Best debt consolidation companies in 2025

Credible

Best Marketplace

Why it’s one of the best

Credible is an online marketplace that allows you to compare debt consolidation loans from multiple lenders in one place. You’ll find unsecured personal loans ranging from $1,000 to $200,000, with some lenders offering secured loan options.

Credible charges no fees, though some lenders may. You can obtain multiple quotes without a hard credit check, allowing you to easily compare different personal loans for debt consolidation.

| Rates (APR) | 7.74% – 15.94%1 |

| Loan amounts | $1,000 – $200,000 |

| Repayment terms | 12 – 120 months |

| Min. credit score | 580 |

SoFi

Best for Good Credit

Why it’s one of the best

SoFi is a top-rated personal loan lender for borrowers with good credit history. The maximum loan limit is $100,000, and you can take up to seven years to repay what you borrow.

SoFi offers multiple discounts to help bring your rate down, and there are no origination, prepayment, or late payment fees. Customer support is available seven days a week to answer questions or help with any issues you might have with your loan account.

| Rates (APR) | 8.99% – 29.99% with all discounts2 |

| Loan amounts | $5,000 – $100,000 |

| Repayment terms | 24 – 84 months |

| Min. credit score | 600 |

Figure

Best Home Equity Option

Why it’s one of the best

Figure offers a flexible home equity line of credit that you can use to consolidate your high-interest debt. The amount you can borrow will depend on your credit scores, income, and equity value, though the maximum loan limit is well above what you could get with the best personal loans.

A Figure HELOC could put funds in your hands in as little as five days, and you don’t need to complete an in-person appraisal to get approved. Excellent credit is recommended, though borrowers with good credit can still qualify.

| Rates (APR) | 8.35% – 16.55% |

| Loan amounts | $15,000 – $750,000 |

| Repayment terms | 5, 10, 15, or 30 years |

| Min. credit score | 640, but 720+ is advised |

Upgrade

Best for Fair Credit

Why it’s one of the best

Upgrade personal loans offer flexibility, since you can choose your repayment term and payment due date. Borrowers with lower credit scores can qualify for a debt consolidation loan by themselves, or with a joint applicant. The minimum loan is $1,000, which is below the threshold some competitor lenders set. While these loans are geared toward people with fair credit, rates are still competitive and Upgrade offers multiple opportunities to qualify for discounts.

| Rates (APR) | 8.49% – 35.99% |

| Loan amounts | $1,000 – $50,000 |

| Repayment terms | 24 – 84 months |

| Min. credit score | 580 |

LightStream

Best for Excellent Credit

Why it’s one of the best

Lightstream personal loans are designed for borrowers with excellent credit. You can use Lightstream loans for virtually any purpose, including debt consolidation. Rates are competitive and there are no application fees, origination fees, or late payment fees.

The application process is entirely digital and some borrowers may be eligible to get their loan proceeds deposited into their bank account the same day they’re approved.

| Rates (APR) | 7.99%% – 25.49%%, varies by loan type and credit profile |

| Loan amounts | $5,000 – $100,000 |

| Repayment terms | 24 – 144 months |

| Min. credit score | 660 |

Upstart

Best for Thin Credit

Why it’s one of the best

A thin credit file could make it difficult to qualify for some debt consolidation loans. Upstart helps to solve that problem by lending to borrowers with limited credit history.

Rather than requiring a minimum credit score to qualify, Upstart considers your work history, education, and earning potential for approval decisions. You can get a rate quote without impacting your credit profile, and if approved, funds may be available as quickly as the next business day.

| Rates (APR) | 8.49% – 35.99% |

| Loan amounts | $1,000 – $50,000 |

| Repayment terms | 36 or 60 months |

| Min. credit score | None |

Happy Money

Best for Credit Card Debt

Why it’s one of the best

Happy Money offers debt consolidation loans exclusively to people with credit card debt. If approved, you can choose your repayment term and payment date. You can also direct Happy Money to pay your creditors directly for added convenience.

An origination fee may apply for certain borrowers, but the fee range is lower than what you might pay for other loans. Happy Money personal loans for debt consolidation are available in all states, except Nevada and Massachusetts.

| Rates (APR) | 11.72% – 17.99% |

| Loan amounts | $5,000 – $40,000 |

| Repayment terms | 24 – 60 months |

| Min. credit score | 640 |

What is a debt consolidation loan?

A debt consolidation loan is a loan that’s used to pay off credit cards, loans, and other debts. Here’s how it works, in a nutshell:

- You apply for a loan in the amount you need to pay off other debts.

- If approved, the lender releases the loan funds to you.

- You use the money to pay off your other debts, leaving you with one payment to make to the loan each month.

Debt consolidation loans may be unsecured or secured. Unsecured loans are not attached to collateral, while secured loans are. Typically, when you’re talking about debt consolidation loans you’re talking about one of these options:

- Personal loans

- HELOCs

- Home equity loans

HELOCs and home equity loans are second mortgages that you repay in addition to the mortgage you took out to buy the home. A HELOC gives you access to a revolving line of credit that works like a credit card. Home equity loans give you a lump sum that you can use to pay debts.

Unsecured personal loans can be attractive for debt consolidation if you don’t own a home or don’t want to have an additional mortgage payment.

When choosing a debt consolidation loan, I would look for the best (lowest) interest rate at the best terms. Compare the payments—really understand what your new loan payments will cost. I would also like to understand their service model if you need support or have questions. Can you call a live person, or is it all serviced via off-shore chat?

Pros and cons

Pros

-

Fewer monthly debt payments

Consolidating all your debt payments into one can help ease budgeting stress.

-

Rates may be lower than what you’re currently paying

If you consolidation loan rate is lower than what you pay to credit cards or other debts, you can save you more in the long-run in interest.

-

Discounts may bring down the cost of the loan

-

Some lenders offer repayment and due date flexibility

Flexible repayment terms and the ability to choose your due date can make it easier to fit paying off debt into your full financial picture.

-

Collateral not always required

If your debt consolidation loan is unsecured, you don’t risk losing your home, car, or other belongings if you aren’t able to repay.

Cons

-

Consolidation may be a band-aid solution at best

If you continue to use credit cards after paying them off, you could find yourself in a worse debt situation than before you consolidated.

-

Good to excellent credit is usually needed

To get the lowest rates and best terms, you typically need good to excellent credit

-

Lower rates are not guaranteed

Just because you apply for a debt consolidation loan doesn’t mean you’ll qualify for a lower rate, making it crucial to crunch the numbers to ensure you’ll be saving in interest in the long run.

-

Lenders may charge fees

Lenders may charge application, origination, prepayment, and late payment fees that can cut into your savings.

-

Debt consolidation loan interest is not tax-deductible

In some cases, like when you use a HELOC to make home improvements, you can deducted the interest you pay on the loan on your taxes. This isn’t possible, however, if you use the funds to consolidate debt.

Eligibility requirements

Lenders determine eligibility for debt consolidation loans and requirements can vary greatly. Typically, the most important factors in loan decisions include:

- Credit scores

- Income

- Employment history

- Existing debt levels

- Home equity (if you’re applying for a HELOC or home equity loan)

You can raise your approval odds by reviewing your credit scores to see if there’s room for improvement. Paying down some of your existing debt, for example, could give you a slight score boost and potentially make you more attractive to a lender. Increasing your income with side hustles or part-time work could also make a difference.

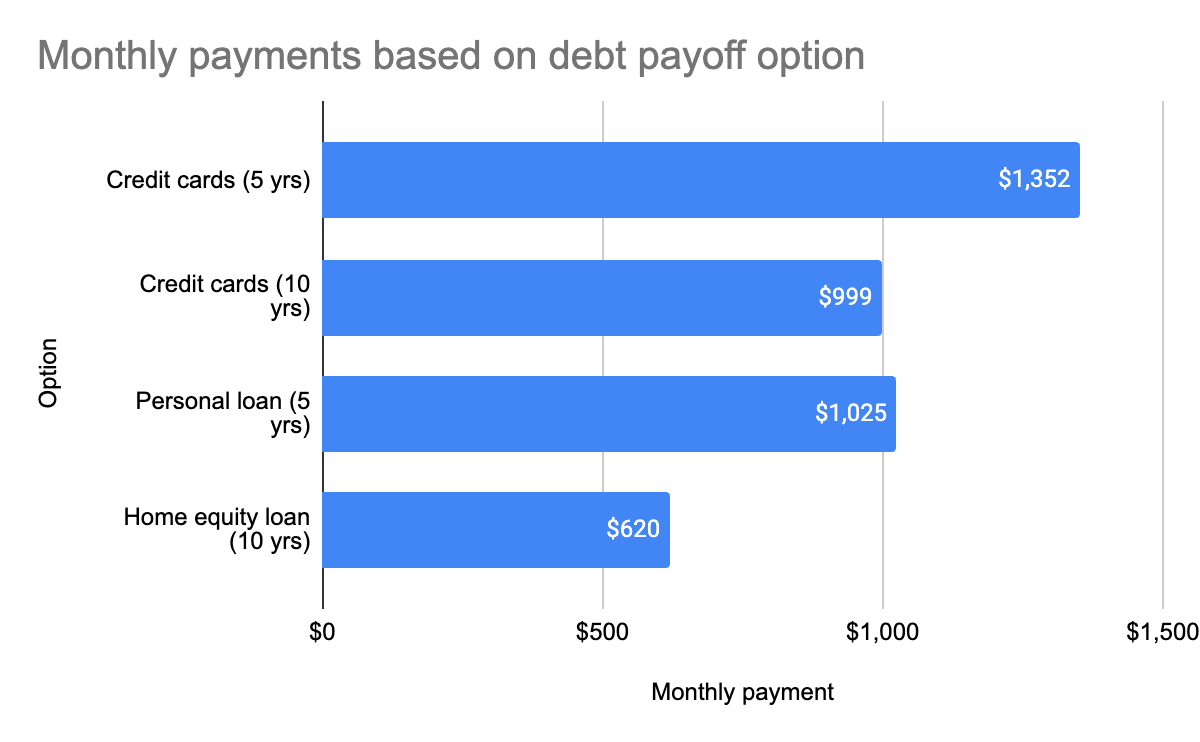

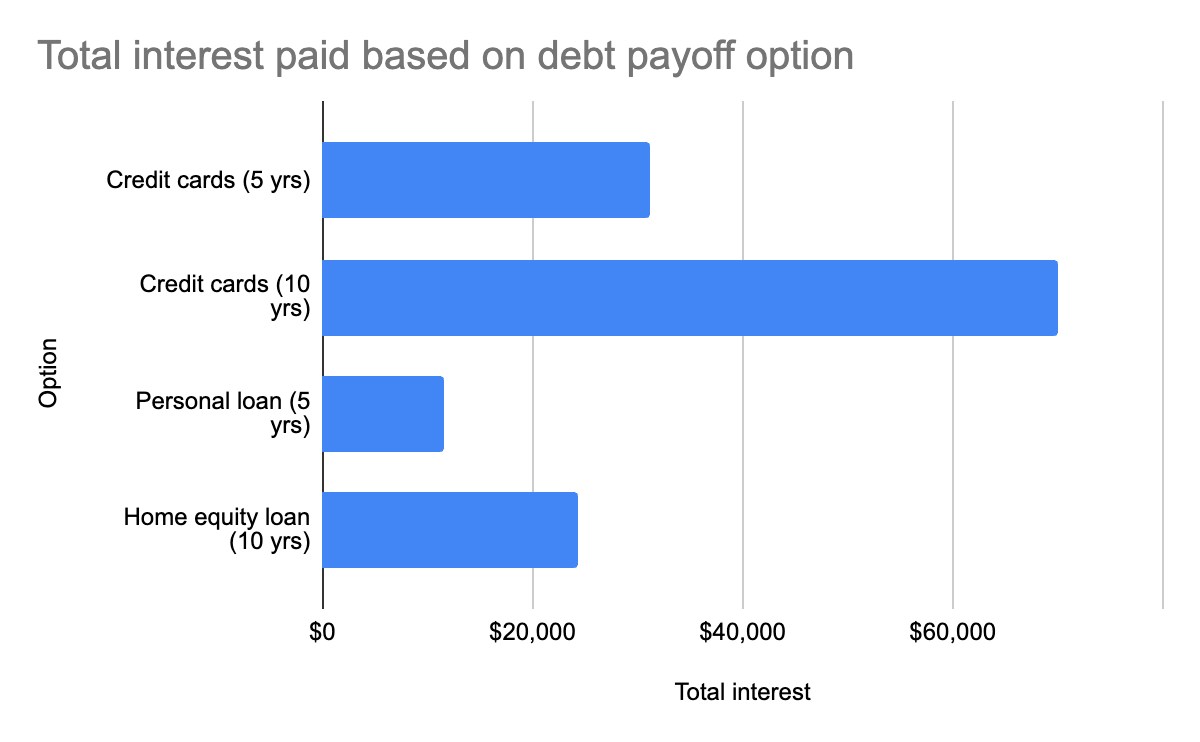

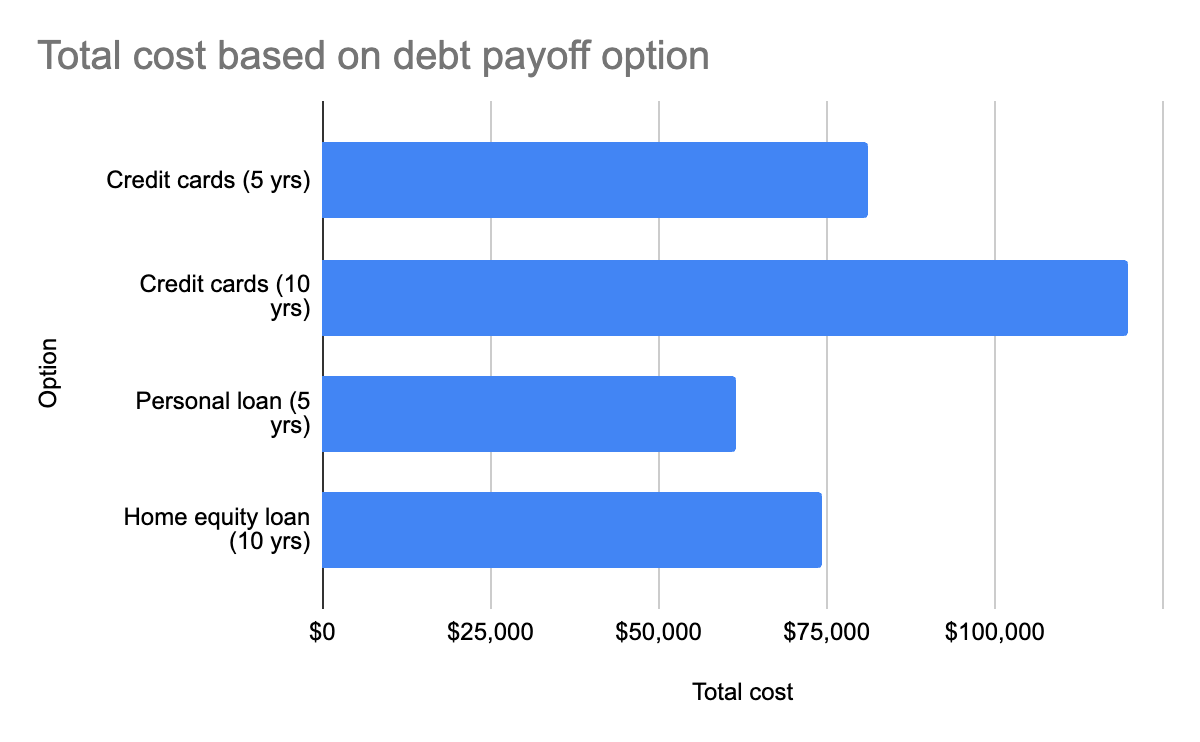

Debt consolidation loan examples

How much could a debt consolidation loan save you? Here are two examples to help you decide.

Let’s say you want to refinance $50,000 in credit card debt. Your average APR is 21%, and you have a 720 credit score. Here’s what you might pay with a personal loan versus a home equity loan—and how that compares to doing nothing at all.

| Option | APR | Monthly payment | Total interest | Total cost |

| Credit cards (5 yrs) | 21% | $1,352 | $31,160 | $81,160 |

| Credit cards (10 yrs) | 21% | $999 | $69,959 | $119,959 |

| Personal loan (5 yrs) | 8.50% | $1,025 | $11,550 | $61,550 |

| Home equity loan (10 yrs) | 8.50% | $620 | $24,391 | $74,391 |

Alternatives

If a loan isn’t the right fit, consider these alternatives to debt consolidation.

Debt management plan (nonprofit)

A DMP through a nonprofit credit counseling agency rolls multiple credit card bills into one payment. Counselors negotiate lower interest rates and fees (not principal reductions), and you’ll usually close enrolled cards. It’s good when debt feels manageable and you’re committed to ending the debt cycle.

Recommended provider: American Consumer Credit Counseling

Balance transfer credit card

A 0% intro rate card can pause interest for six to 21 months (balance transfer fee is usually 3% to 5%). It works best if you can pay off the entire balance before the promo ends and avoid new purchases.

Debt relief companies that offer consolidation services

Some reputable debt relief companies also provide debt consolidation options. Instead of negotiating settlements, these programs combine your unsecured debts into a single monthly payment, often with the help of a credit counselor or advisor.

An advisor can review your situation, explain whether consolidation is the right path, and connect you with partner lenders or counseling services. This approach may lower your interest rates, simplify repayment, and give you more structure compared to managing multiple accounts on your own.

Recommended provider: National Debt Relief

Debt relief vs. debt consolidation: What’s the difference?

- Debt consolidation: Combines multiple debts into one payment, often with lower interest. You still repay the full balance, just in a simplified structure.

- Debt relief (settlement): Negotiates with creditors to settle for less than you owe. This can reduce your total balance but may hurt your credit score.

Some companies, such as National Debt Relief, offer both paths to help you decide whether streamlining payments or settling balances is the better fit.

Home equity (HELOC or home equity loan)

You may get lower rates and longer terms, but these are secured by your home. Default can lead to foreclosure, and the total interest paid can rise with longer timelines. Use only with a payoff plan and stable cash flow.

Recommended provider: Figure

DIY payoff methods

The debt snowball (smallest balance first) and debt avalanche (highest APR first) build momentum without new credit. Automate payments and earmark windfalls (bonuses, tax refunds) to speed results.

Before taking a debt consolidation loan, consider other strategies, like the snowball or avalanche method, picking up a side hustle, or cutting expenses with “poverty months” where you live on the bare minimum. Gamify the process to stay motivated. If you still struggle, a credit counselor can guide you. No one is taught personal finance in school, so be proactive: Focus on improving your credit after payoff and avoid taking on “bad debt” in the future.

How to choose the best debt consolidation company

Use this checklist to compare debt consolidation companies and find a fit for your budget and credit profile.

- Rate and total cost: Compare rate (APR) ranges and run payment/interest math for your term.

- Origination and other fees: Note origination, late, prepayment, annual fees (if any).

- Repayment terms: Shorter terms = less interest; longer terms = lower payments.

- Eligibility: Minimum credit score, DTI, income; joint borrower/cosigner options.

- Credit impact: Prequalification with a soft credit check; how funding affects utilization.

- Loan amounts: Minimum/maximum you can borrow for true consolidation.

- Funding speed: How quickly funds arrive; direct-to-creditor payoff available?

- Discounts: Autopay, loyalty, or relationship rate discounts.

- Hardship options: Forbearance, payment deferral, or term adjustments if income drops.

- Secured vs. unsecured: Any collateral required? (Most personal loans are unsecured.)

- State availability and customer support: Phone hours, live agents, and reviews.

FAQ

What credit score do you need for a debt consolidation loan?

Most lenders look for a credit score of at least 580, but a score of 670 or higher gives you better approval odds and access to lower interest rates.

Are there debt consolidation loans for bad credit?

Yes, but your options may be limited, and rates will be higher. Some lenders specialize in working with borrowers who have bad credit (typically under 580). You may still be able to get a loan, but expect stricter terms and higher interest rates. Adding a cosigner or applying for a secured loan may help improve your chances and lower your rate.

Do debt consolidation loans hurt your credit?

It may cause a small dip at first, but it can help your credit in the long run. Applying for a loan triggers a hard credit check, which can temporarily lower your score. However, if you use the loan to pay off revolving debt (like credit cards), you may see a credit score boost over time—especially if you keep your old credit lines open and make all loan payments on time.

How we chose the best debt consolidation loans

Since 2017, LendEDU has evaluated personal loan companies to help readers find the best personal loans. Our latest analysis reviewed 1,029 data points from 49 lenders and financial institutions, with 21 data points collected from each. This information is gathered from company websites, online applications, public disclosures, customer reviews, and direct communication with company representatives.

These star ratings help us determine which companies are best for different situations. We don’t believe two companies can be the best for the same purpose, so we only show each best-for designation once.

1 Rates for personal loans provided by lenders on the Credible platform range between 6.94% – 35.99% APR with terms from 12 – 120 months. Credible also works with network Partners like MoneyLion and AmONE, who offer loan and other products with different rates and terms than described here. Rates presented include lender discounts for enrolling in autopay and loyalty programs, where applicable. Actual rates may be different from the rates advertised and/or shown and will be based on the lender’s eligibility criteria, which include factors such as credit score, loan amount, loan term, credit usage and history, and vary based on loan purpose. The lowest rates available typically require excellent credit, and for some lenders, may be reserved for specific loan purposes and/or shorter loan terms. The origination fee charged by the lenders on our platform ranges from 0% to 12%. Each lender has their own qualification criteria with respect to their autopay and loyalty discounts (e.g., some lenders require the borrower to elect autopay prior to loan funding in order to qualify for the autopay discount). All rates are determined by the lender and must be agreed upon between the borrower and the borrower’s chosen lender. For a loan of $10,000 with a three year repayment period, an interest rate of 7.99%, a $350 origination fee and an APR of 10.43%, the borrower will receive $9,650 at the time of loan funding and will make 36 monthly payments of $313.32, assuming your lender deducts the origination fee from the offered loan amount. Assuming all on-time payments, and full performance of all terms and conditions of the loan contract and any discount programs enrolled in included in the APR/interest rate throughout the life of the loan, the borrower will pay a total of $11,279.43. As of March 3, 2022, none of the lenders on our platform require a down payment nor do they charge any prepayment penalties.

2 SoFi Platform personal loans are made either by SoFi Bank, N.A. or , Cross River Bank, a New Jersey State Chartered Commercial Bank, Member FDIC, Equal Housing Lender. SoFi may receive compensation if you take out a loan originated by Cross River Bank. These rate ranges are current as of 3/06/23 and are subject to change without notice. Not all rates and amounts available in all states. See SoFi Personal Loan eligibility details at https://www.sofi.com/eligibility-criteria/#eligibility-personal/ . Not all applicants qualify for the lowest rate. Lowest rates reserved for the most creditworthy borrowers. Your actual rate will be within the range of rates listed above and will depend on a variety of factors, including evaluation of your credit worthiness, income, and other factors.

Loan amounts range from $5,000– $100,000. The APR is the cost of credit as a yearly rate and reflects both your interest rate and an origination fee of 9.99% of your loan amount for Cross River Bank originated loans which will be deducted from any loan proceeds you receive and for SoFi Bank originated loans have an origination fee of 0%-7%, will be deducted from any loan proceeds you receive.

Autopay: The SoFi 0.25% autopay interest rate reduction requires you to agree to make monthly principal and interest payments by an automatic monthly deduction from a savings or checking account. The benefit will discontinue and be lost for periods in which you do not pay by automatic deduction from a savings or checking account. Autopay is not required to receive a loan from SoFi.

Direct Deposit Discount: To be eligible to receive an additional (0.25%) interest rate reduction on your Personal Loan (your “Loan”), you must set up Direct deposit with a SoFi Checking and Savings account offered by SoFi Bank, N.A., or enroll in SoFi Plus by paying the SoFi Plus Subscription Fee, all within 30 days of the funding of your Loan. Once eligible, you will receive this discount during periods in which you have enabled Direct Deposit to an eligible Direct Deposit Account in accordance with SoFi’s reasonable procedures and requirements to be determined at SoFi’s sole discretion, or during periods in which SoFi successfully receives payment of the SoFi Plus Subscription Fee. This discount will be lost during periods in which SoFi determines you have turned off Direct Deposit to your Checking and Savings account or in which you have not paid for the SoFi Plus Subscription Fee. You are not required to enroll in Direct Deposit or to pay the SoFi Plus Subscription Fee to receive a Loan.

About our contributors

-

Written by Rebecca Lake, CEPF®

Written by Rebecca Lake, CEPF®Rebecca Lake is a certified educator in personal finance (CEPF®) and freelance writer specializing in finance.

-

Reviewed by Catherine Valega, CFP®, CAIA®

Reviewed by Catherine Valega, CFP®, CAIA®Catherine Valega, CFP®, CAIA®, founded Green Bee Advisory LLC to help women, philanthropists, investors, and small businesses build, manage, and preserve their financial resources. She's been practicing financial planning for more than 20 years.